In response to the 2020 COVID pandemic, the US government announced the student loan payment moratorium as a form of relief for federal student loan borrowers. In Sept. 2023, the payment pause ended and the Department of Education began the process of bringing eligible federal student loan borrowers into repayment. Our study aims to assess the landscape of student loan borrowers following the end of the payment pause and resumption of payments. Currently, there are more than 45 million federal student loan borrowers who own a cumulative total of more than $1.6 trillion in federal student loan debt.1

Embold Research surveyed 1,006 federal student loan borrowers nationwide from February 29-March 11, 2024.

Key Insights

- Only around 60% of federal student loan borrowers have started or resumed payments since the end of the moratorium in October of 2023, while 40% of borrowers have not started or resumed payments. Borrowers report a variety of challenges to repayment including: financial strain, government policy uncertainty (especially, related to broad-based loan forgiveness), the need to adjust their budgets, and feelings of anxiety or stress.

- To assist borrowers with the transition back to repayment, there is an on-ramp period that prevents the worst consequences of missed, late, or partial payments running through September 2024. However, very few borrowers are aware of this assistance, with less than 5% of borrowers knowledgeable of the details associated with the on-ramp period.

- The hope of broad-based loan forgiveness continues to loom large for many borrowers, as nearly half have changed their plans for repayment due to the public discourse on loan forgiveness.

- While borrowers rely on federal government offices for information on student loans, a majority of borrowers believe that the federal government has not been effective in communicating with borrowers about the end of the moratorium and their repayment options.

- This belief is particularly pronounced among borrowers without a Bachelor’s degree and/or those from lower-income households. These borrowers are less likely to feel they understand the details associated with their loans and are much less likely to be aware of alternative repayment programs, such as IDR plans, intended to help those from lower-income households.

Borrowers’ Financial Priorities & Understanding of their Loans

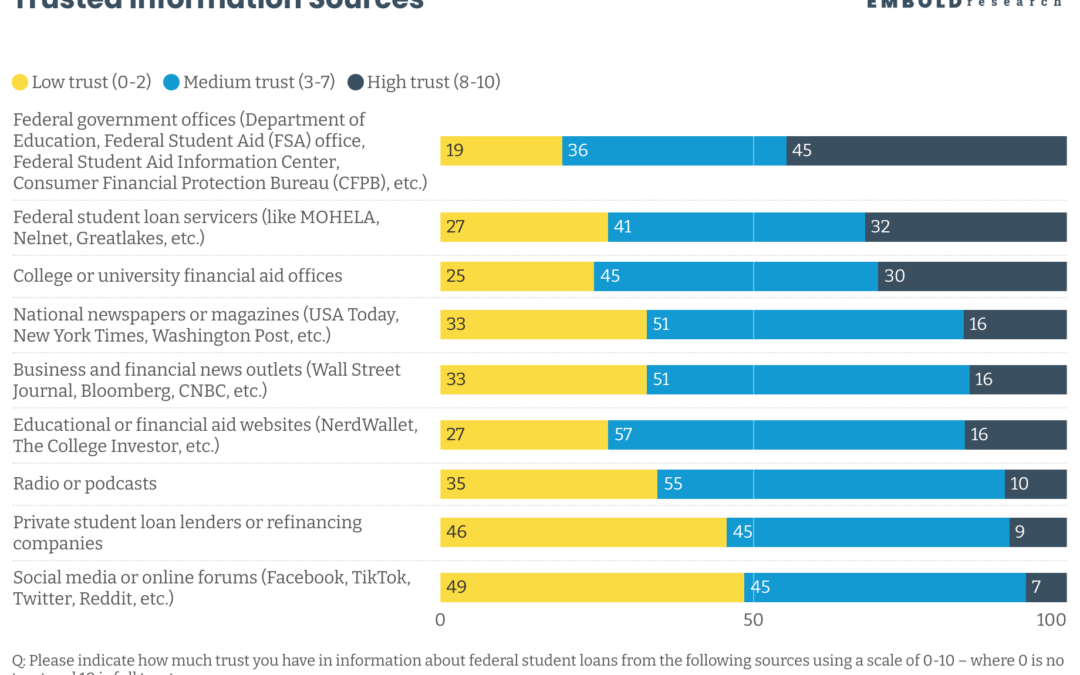

Student loan borrowers commonly prioritize the ability to cover regular expenses, like housing or groceries, over competing financial priorities such as paying off debt, maximizing their household’s income, or saving for retirement. When asked to rank 7 financial priorities in order of personal importance (1 = most important, 7 = least important), nearly 60% of respondents rank the ability to cover regular expenses the most important and the average ranking across all borrowers is 2.05. While borrowers commonly prioritize covering their everyday expenses, they differ in the importance they assign to other financial goals. Securing adequate insurance coverage came in second with an average rating of 3.80, followed closely by paying off debt (3.97), saving for emergencies or large purchases (4.0), and maximizing their household’s income (4.10). Most borrowers agree, however, that the ability to spend on non-essential items or experiences that bring them joy (average ranking = 4.98) and saving for retirement (5.0) are less pressing concerns. Approximately one in four borrowers considered these to be their lowest financial priorities.

The importance borrowers place on repaying their federal student loans varies widely. About one-quarter (23%) of borrowers consider repayment a high priority, giving it a rating of 8-10. In contrast, one third of borrowers view repaying their federal student loans as a low priority (0-2), including nearly 20% who say repayment is “not at all a priority”. Age plays an important role in this prioritization, with younger borrowers typically assigning less importance to repayment than older borrowers. Political ideology also appears to influence borrowers’ attitudes toward repayment – 28% of self-identified Republicans rate repayment as a high priority (8-10), compared to 22% of Independents and 21% of Democrats.

A majority of borrowers indicate that they have at least some understanding of the details associated with their student loans and the repayment program in which they are enrolled but relatively few report a strong understanding of their loans (28%) and their repayment program (32%). Conversely, around three in ten borrowers express that they do not understand the details associated with their loans (31% total disagree) and the repayment program in which they are enrolled (28% total disagree).

Borrowers’ understanding of their loans is shaped by their level of education: Borrowers with a Bachelor’s degree or higher are more likely to strongly agree that they understand the details associated with their federal student loans (31%) than those without a Bachelor’s degree (21%).2 This educational disparity extends to knowledge of repayment programs, where degree holders also demonstrate a greater awareness of both their current repayment programs and the alternative repayment programs available to them.

Repayment After the End of the Moratorium

Nearly 40% of borrowers report that they have not started or resumed making payments on their federal student loans since the end of the moratorium in October of 2023. Annual household income is a key driver in whether borrowers have started or resumed repaying their federal student loans. Borrowers from high-income households are much more likely to have started or resumed repaying their loans than those from low-income households. In fact, less than 30% of borrowers earning under $35,000 per year have started or resumed repayment. However, even among wealthier households, a notable share of borrowers have not started or resumed repayment. For example, 23% of borrowers earning between $100,000-$149,999 have not (re)started repayment.

Since the end of the moratorium, most borrowers have encountered difficulties as they begin or resume repayment of their student loans, highlighting a wide range of challenges. Financial strain is the most commonly experienced setback to repayment, with a majority of borrowers reporting they experienced financial strain (58%). Other common challenges to repayment include government policy uncertainty (e.g., anticipation of student loan forgiveness) (42%),the need to adjust their budget (41%), and feelings of anxiety or stress (36%). Around one quarter of borrowers also report experiencing confusion around repayment plans (23%). Only 14% of borrowers indicate that they have not faced any difficulties starting or resuming repayment of their federal loans.

The hope of broad-based student loan forgiveness has influenced the repayment strategies of many federal student loan borrowers. Nearly half of borrowers report that the hope of loan forgiveness has impacted their plans for repayment “a lot” or “some” (46%). Notably, 27% of borrowers have deliberately slowed down the repayment of their loans in response to potential forgiveness. Younger borrowers and those who identify as Democrats are particularly inclined toward adjusting their repayment plans under the hope of student loan forgiveness. Conversely, 30% of borrowers report that their repayment strategies remain unchanged despite the possibility of forgiveness.

Awareness of the On-Ramp Period and IDR Plans

Few borrowers are aware of the repayment on-ramp period that runs through September 2024. In an open-ended question asking borrowers what they have seen or heard, if anything, about the on-ramp period, a significant majority of respondents had no awareness of the on-ramp period and many others confused the on-ramp period with new repayment programs and/or loan forgiveness. Overall, less than 5% of borrowers indicated an awareness of the on-ramp period and the details associated with it.

Prior to the survey, two in five borrowers were not aware that interest has been accruing on their loans since the end of the moratorium in October of 2023. Around 60% of all borrowers were already aware that interest has been accruing on their loans but those with a Bachelor’s degree or higher were much more likely to be aware (65%) than those without a four-year degree (51%). Additionally, awareness that federal student loans are currently accruing interest is higher among those who have started or resumed their loan payments (69%) than those who have not yet (re)started repayment (50%). Because over 90% of borrowers were unaware of the on-ramp period’s existence, however, it is reasonable to infer that many assumed interest was accruing during the on-ramp period.

A majority of borrowers are knowledgeable about the income-driven repayment (IDR) plans that are offered to federal student loan borrowers. Over 60% of borrowers report that they are at least “somewhat knowledgeable” about the IDR plans available, including 25% of borrowers who are “very knowledgeable”. In contrast, 21% of borrowers have no knowledge of the IDR plans that are offered. Knowledge of the IDR plans available to borrowers is higher among younger borrowers, white borrowers, and those with at least a Bachelor’s degree. Importantly, although IDR plans are intended to assist borrowers from lower-income households make their monthly payments, it is actually borrowers from higher-income households who are more likely to be knowledgeable of these repayment plans.

Two in five borrowers are currently enrolled in one of the four IDR plans available, with another 11% planning to enroll in the future. Among borrowers enrolled in an IDR plan, the Income-Based Repayment (IBR) plan is the most common (50% of IDR enrollees), followed by the new Saving on a Valuable Education (SAVE) plan (34%). While 51% of borrowers are currently enrolled in an IDR plan or plan to enroll in the future, 24% of borrowers have no intentions of enrolling in an IDR plan. Additionally, approximately 25% of all borrowers do not know whether they are enrolled in an IDR plan (19%) or believe they are enrolled in an IDR plan, but are not sure which one (6%).

Sources of Information

Borrowers commonly agree that the federal government has not effectively communicated about the resumption of federal student loan payments and the different repayment options available to borrowers. Only one third of borrowers rate the federal government’s communication around the end of the moratorium as “excellent” or “good”, while 36% of borrowers rate this communication as “poor”. Evaluations of the federal government’s communication on repayment options are even worse. Nearly half of borrowers rate the government’s communication around the repayment plans available to borrowers (44%) and the options available for borrowers unable to make their payments as “poor” (46%).

Borrowers most frequently turn to official sources, including student loan servicers and federal offices, for information on loan repayment. Over half of borrowers get information from their loan servicers (54%) and nearly half (47%) report getting information from federal offices, like the Department of Education and the Federal Student Aid (FSA) office. Outside of official information sources, borrowers most commonly rely on information they see on social media or online forums (36%) and national newspapers (26%).

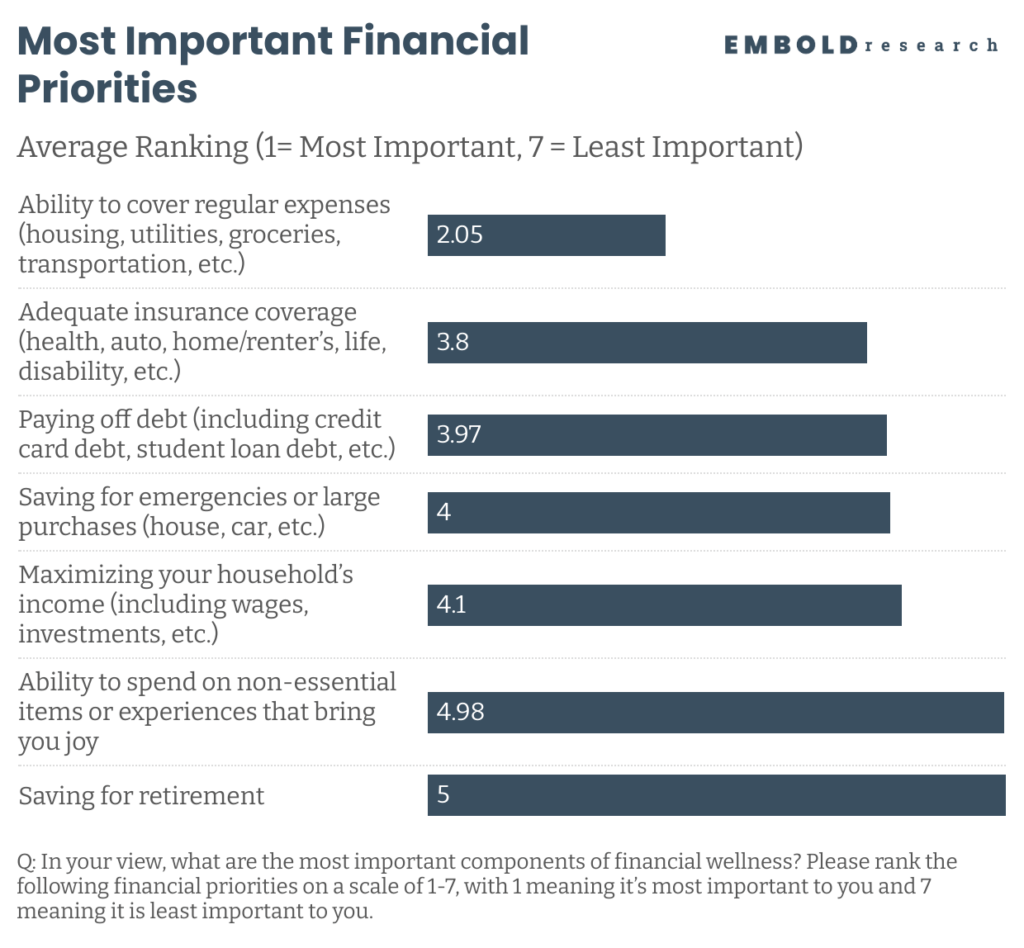

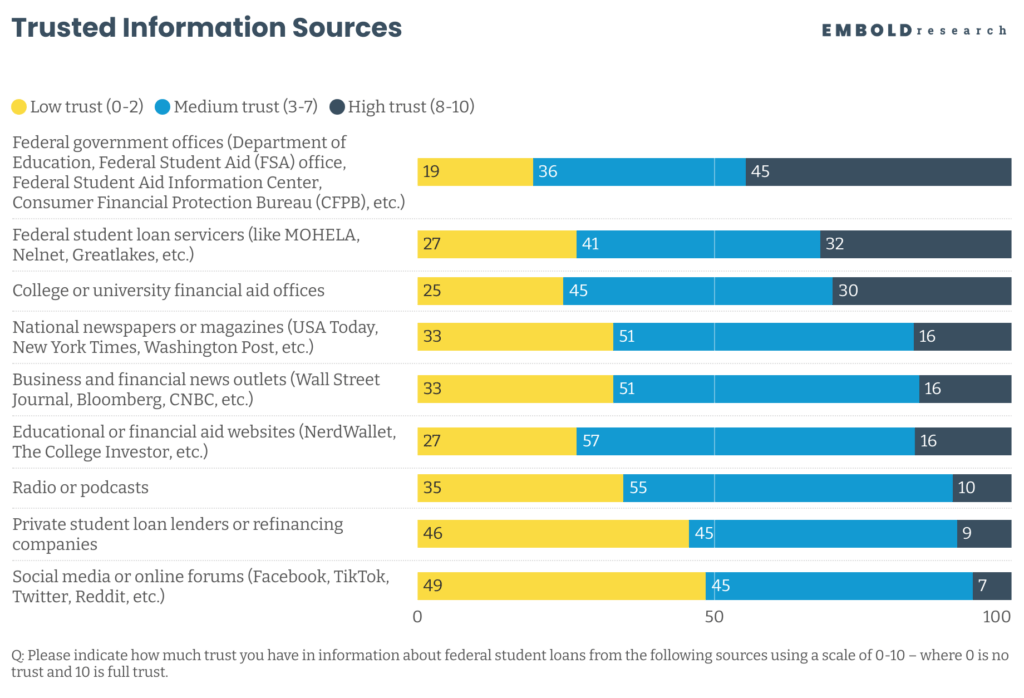

Despite borrowers typically relying on their loan servicers and federal offices for information about federal student loans, many borrowers do not have a high degree of trust in the information they receive from these sources. Borrowers trust information from federal government offices, such as the Department of Education or the FSA office, more than they trust information from any other source tested. However, only 45% indicate a high level of trust (ratings 8-10) in the information from federal offices and approximately one in five borrowers have a low level of trust (ratings 0-2) in this information source. Borrowers are less trusting of their loan servicers. Approximately one third of borrowers have a high level of trust in the information from their loan servicer while 27% have a low level of trust. When it comes to unofficial information sources, trust is even lower. Less than 20% of borrowers have a high level of trust in the information they receive from national newspapers and nearly half of borrowers have a low level of trust (0-2) in the information they receive from social media or online forums.

Methodology & Footnotes

Polling was conducted online from February 29-March 11, 2024. Using Dynamic Online Sampling to attain a representative sample, Embold Research polled 1,006 federal student loan borrowers nationwide. Post-stratification was performed on age and census region. You can see a full methodology statement here, which complies with the requirements of AAPOR's Transparency Initiative. Members of the Transparency Initiative disclose all relevant details about our research, with the principle that the public should be able to evaluate and understand research-based findings, in order to instill and restore public confidence in survey results. The modeled margin of error = +/- 3.2%

1: (Department of Education Office of Federal Student Aid. 2023 Annual Report.)

2: Sixty-seven percent of the sample has a Bachelor’s degree or higher.